After the Display vs Discovery Ads challenge, we decided to run a new test in the last part of 2023 to compare Demand Gen campaigns’ performance to that of “regular” Display campaigns. As in the previous experiment, we set the same budget for about 30 days, using the same content & targeting options. Here’s what happened.

This time we promoted ADworld Experience video-recording sales. As some of you may already know, ADworld Experience is the EU’s largest all-PPC event. Its main target audience is seasoned PPC professionals, who work with Google Ads, Meta Ads, Linkedin, Microsoft, Amazon, TikTok, and other minor online advertising platforms.

During the previous test, we found that experienced PPC professionals could be effectively targeted using an expressed interest in any advanced PPC tool. So we selected the most renowned ones excluding those not directly related to the main platforms.

Here are the brands we targeted in alphabetical order: adalysis, adespresso, adroll, adstage, adthena, adzooma, channable, clickcease, clickguard, clixtell, datafeedwatch, feedoptimise, feedspark, fraudblocker, godatafeed, opteo, optmyzr, outbrain, ppcprotect, producthero, qwaya, revealbot, spyfu, squared and taboola.

Using this list we were able to set up 3 different audiences based on:

- PPC professionals who searched for a PPC tool brand in the past on Google;

- PPC professionals who are interested in a PPC tool;

- Users who have shown interest in PPC tool website URLs in SERPs.

Then we created a Demand Gen campaign and a regular Display campaign, with 3 ad groups each, based on one of the above audiences. The key settings were:

- In both campaigns we limited demographics to users aged 25 to 55 (the main age range of adwexp participants) + unknown (not to limit too much the audience) and in Display campaigns we excluded optimized targeting (to avoid unwanted overlapping).

- The goals were: past edition video-recording sales and navigating 5 or more pages in one session (to grant Google’s smart bidding enough conversion data to work on).

- Geotargeting was limited to the home countries of the majority of ADworld Experience past participants (a selection of EU countries + UK, Switzerland, Norway, and Finland). We targeted all languages used in these countries and scheduled ads to appear every day from 8:00CET to 20:00CET.

- In Demand Gen we had to accept Google’s default filter for moderate and highly sensible content. In Display, we excluded all non-classified content, fit for families (= mainly videos for kids on YouTube), all sensible content, and parked domains.

- The bidding strategy was set for both campaigns on Maximize Conversions, not setting (at least initially) any target CPA.

- The landing page was the same in both campaigns: https://shop.adworldexperience.it/en/

- The daily budget was 20€ for each campaign.

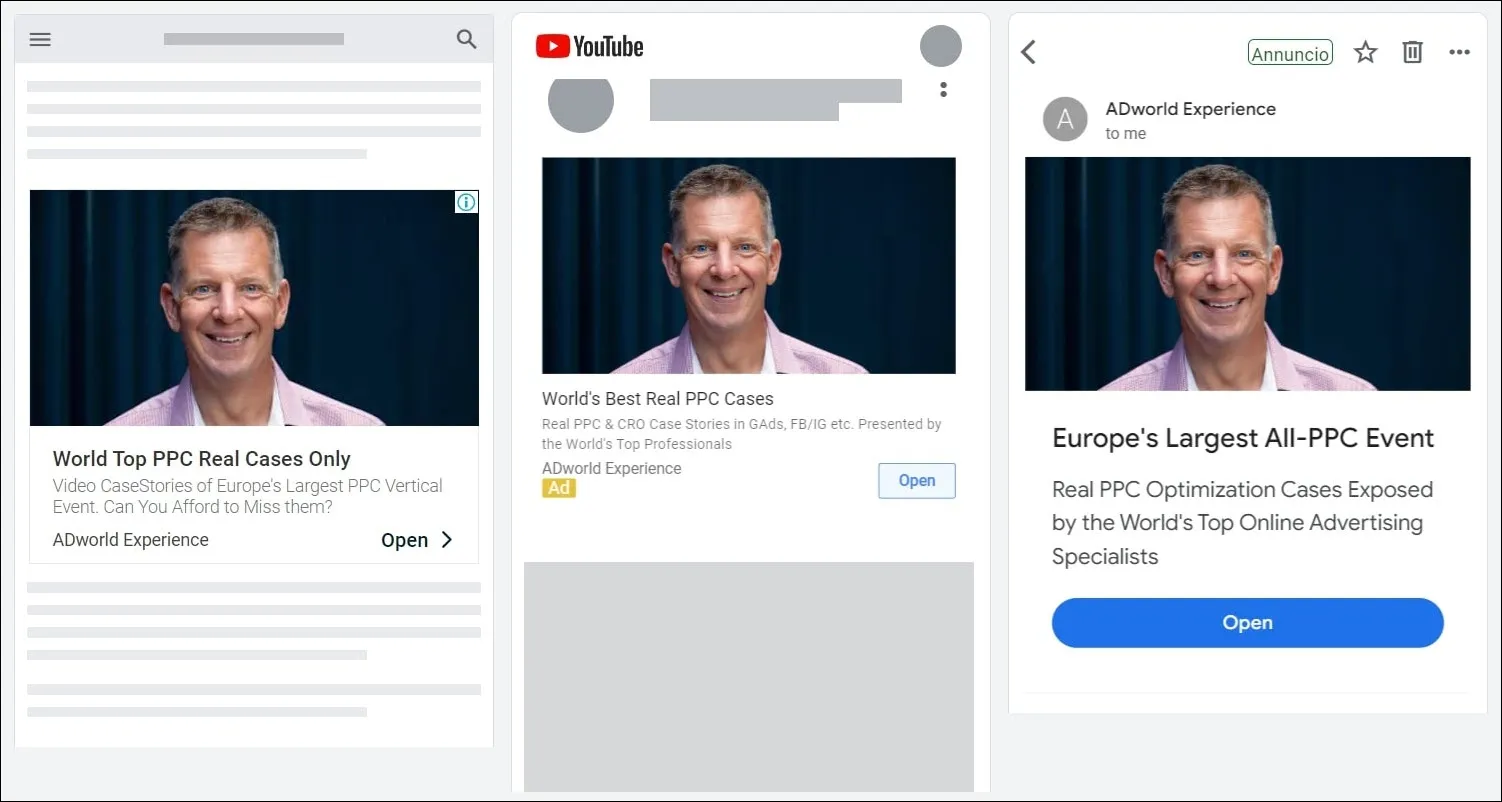

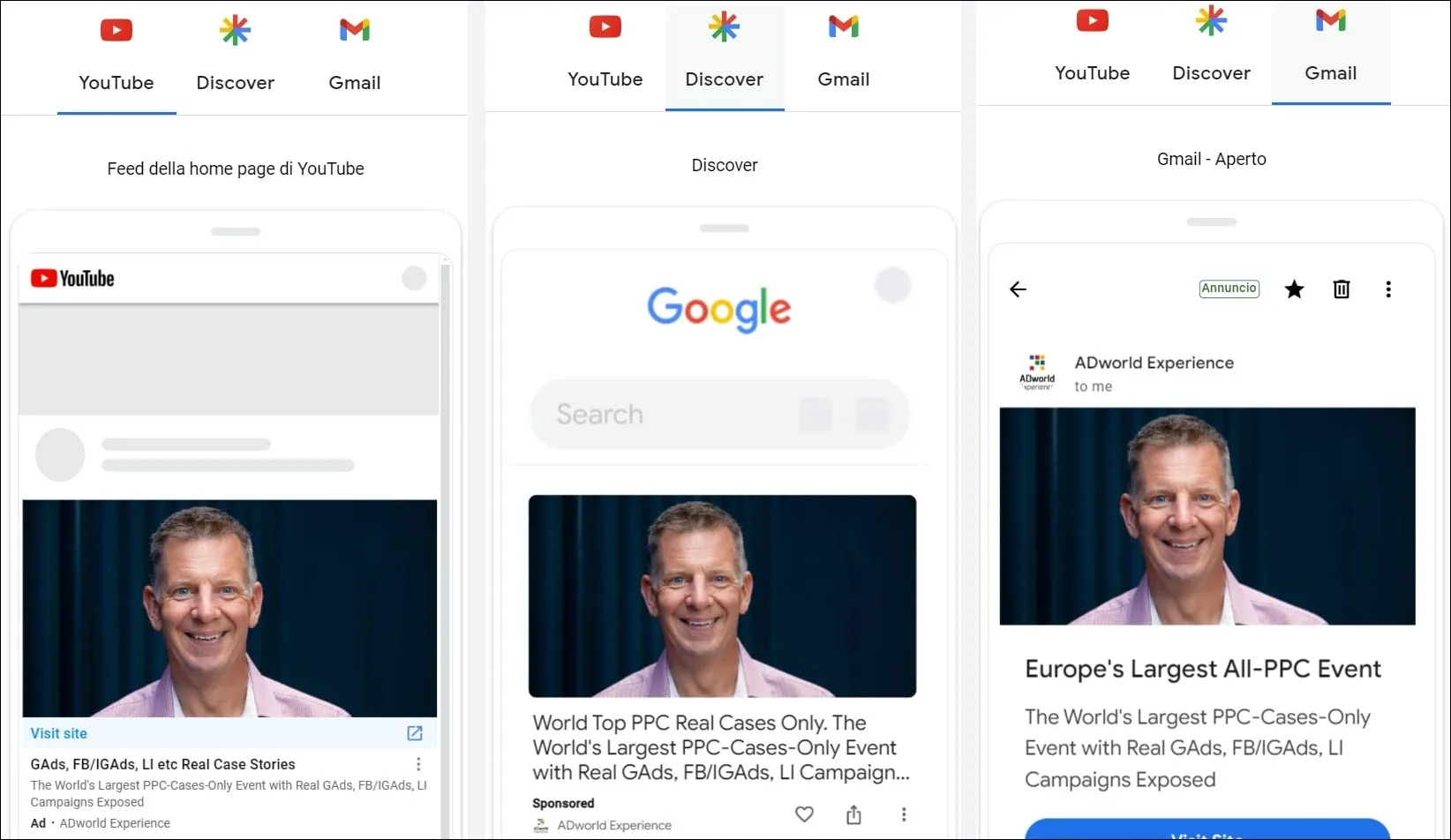

- Text and images were almost exactly the same, even if placements were different (GDN for Display and YouTube, Gmail and Discover newsfeed for Demand Gen). We were forced to shorten some headings in display campaigns, but descriptions and images (mainly 2023 speakers’ photos) were exactly the same. In the Display campaign, we were able to select also some videos and left auto-optimized ad formats on.

Regular Display Ad Examples

Demand Gen Ad Examples

Once we started the experiment, in the Display campaign we were soon forced to set different target CPA to grant all different groups/audiences a more uniform distribution of traffic, lowering it where it spiked and increasing it where it languished. In Demand Gen, we had to pause 2 out of 3 groups to give all of them a minimum threshold of traffic to count on (“Searchers of PPC Tools” adgroup in Demand Gen did 0 impressions for almost 20 days, until that).

In the Display campaign, we excluded all unrelated app categories (all except business/productivity ones) and low-quality placements spotted in the previous test, starting with almost 500 exclusions.

The Results

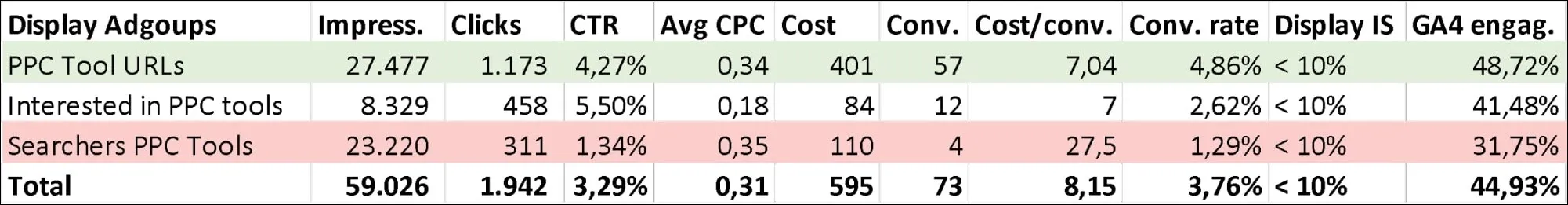

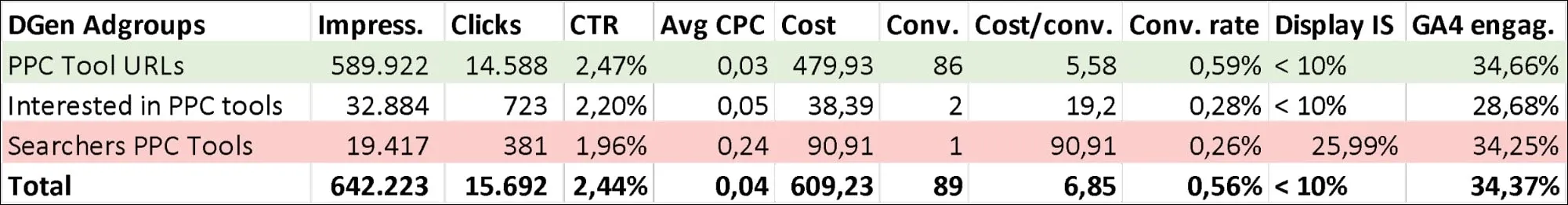

Here are the numbers we had about 5 weeks and 1.200€ spent after.

Regular Display Campaigns

Demand Gen Ads

If we look at global conversion numbers Google seems to have worked very well with Demand Gen. These AI-powered campaigns clearly outperformed both a professionally set Display campaign with the same content/setting and the old Discovery Ads we used in the previous test to promote the 2023 event registration (if we do not consider last week results, that were comparable).

Audiences performed in a fairly homogeneously way in Display, while there was a clear winner in Demand Gen, with the audience built on PPC Tools’ URLs, which Google was very fast to spot just 1 week after the kickoff, while Discovery’s latency on our previous test has been 3 weeks long. The only negative aspect of DGen traffic is the lower percentage of engaged sessions in GA4 (session longer than 10 seconds or with a conversion event or at least 2 pageviews/screenviews). It seems that GDN can still bring to your website more in-target users.

Almost all Demand Gen placements were on YouTube (both the converting ones and the rest), making me say that probably would have been better to compare this campaign with a Video Campaign, more than to a GDN one. The Display campaigns were totally on the other side of the channel, with very few placements alongside videos (& with incredibly high CPCs in some rare, but remarkable cases) and the large majority of impressions & clicks made on regular AdSense network sites.

I was also surprised to see that this time audience performances were comparable in both campaigns, while in the Discovery vs Display test “PPC Tool past searchers” achieved the best Conversion Rates in GDN. To explain that I can only suppose that this was due to the difference in the set goals. Joining an advanced event live is probably more attractive for a PPC pro than looking at its videos afterward. The most laser-targeted audience of someone who has recently searched for a valuable keyword should probably still be the best option in Display, while it is too narrow for DGen.

Final Takeaways

My final takeaway is that if your goal is not only to convert but to drive low-cost (but still well-targeted) traffic to your site with a set-and-forget campaign, then Demand Gen Ads are your must-go.

While, if you have a low budget but want to get results at an acceptable cost and have time and know how to optimize settings, then old-style Display campaigns may still be a good option. In both cases, tests with different audiences & assets are vital if you do not want to throw your money in Google’s vacuum!

If you are curious about specific aspects of the test, reach out to me, and we’ll be happy to drill down the data for you. Now it’s your turn. Did you do any comparison between Demand Gen and regular GDN campaigns? What are your findings?